The Pros and Cons of Starting an Offshore Trust in the Cook Islands

The Pros and Cons of Starting an Offshore Trust in the Cook Islands

Blog Article

The Duty of an Offshore Count On Effective Estate Planning Techniques

Offshore counts on are increasingly identified as a vital element of efficient estate preparation methods. They supply distinct benefits such as possession security, tax benefits, and improved privacy. By separating ownership from control, people can protect their wide range from potential creditors and lawful difficulties. Nonetheless, the complexities surrounding overseas trust funds can question about their implementation and efficiency. Discovering these ins and outs reveals understandings that might meaningfully influence one's monetary legacy

Recognizing Offshore Trusts: A Detailed Review

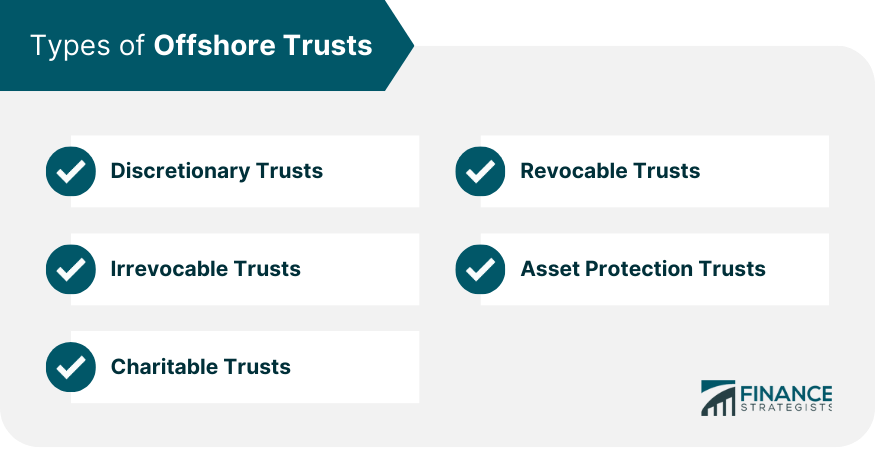

Offshore depends on function as strategic monetary instruments in estate preparation, developed to safeguard properties and supply tax benefits. These depends on are developed in jurisdictions outside the settlor's home country, usually featuring positive lawful frameworks. Commonly, individuals use offshore depend protect riches from political instability, economic downturns, or prospective lawsuits.The core framework of an offshore trust fund entails a settlor, who develops the count on; a trustee, responsible for taking care of the possessions; and beneficiaries, who take advantage of the count on's properties. This separation of ownership and control can boost possession protection, making it extra difficult for financial institutions to assert those assets.Additionally, offshore counts on can assist in estate preparation by guaranteeing a smooth transfer of wide range across generations. They use flexibility concerning possession monitoring and distribution, enabling the settlor to customize the count on according to personal desires and family members needs. This customization is crucial for lasting economic security and family legacy.

The Tax Obligation Benefits of Offshore Trusts

Offshore trust funds provide considerable tax obligation benefits, primarily through tax obligation deferral advantages that can improve wide range conservation. By purposefully placing assets in territories with beneficial tax obligation laws, people can effectively shield their wealth from greater taxation (Offshore Trust). Furthermore, these counts on act as a robust property defense strategy, protecting possessions from financial institutions and lawful claims while maximizing tax obligation performance

Tax Deferment Perks

Often neglected, the tax deferral advantages of counts on developed in international jurisdictions can play an important role in estate planning. These counts on commonly enable individuals to defer taxes on income produced by the count on possessions, which can result in substantial boosts in wealth buildup gradually. By postponing tax obligation obligations, customers can reinvest incomes, enhancing their total financial development. Additionally, the particular tax regulations of various overseas jurisdictions might provide possibilities for further tax optimization. This strategic benefit makes it possible for individuals to align their estate preparing goals with lasting financial goals. Inevitably, understanding and leveraging the tax deferral benefits of overseas trust funds can substantially enhance the effectiveness of an estate plan, guaranteeing that riches is managed and made the most of for future generations.

Possession Defense Strategies

Tax advantages are just one facet of the benefits that offshore trust funds can supply in estate preparation. These depends on act as robust possession protection approaches, protecting properties from legal claims and potential creditors. By transferring assets right into an offshore trust, individuals can develop an obstacle that makes complex lenders' accessibility to those properties. This is specifically useful in territories with positive depend on regulations, supplying an extra layer of safety. Furthermore, overseas trust funds can guard wealth versus unpredicted circumstances, such as legal actions or separation settlements. They also allow individuals to keep control over their possessions while ensuring they are secured from external threats. Inevitably, the calculated use of overseas trusts can boost both financial protection and estate planning efficiency.

Possession Defense: Guarding Your Wide range

Privacy and Privacy in Finance

In the domain name of estate preparation, preserving privacy and discretion is a significant worry for several people. Offshore counts on function as an effective tool to accomplish these objectives, as they can properly protect economic events from public scrutiny. By placing possessions in an offshore trust, individuals can lessen the threat of undesirable direct exposure to their wealth and economic strategies.The inherent features of overseas depends on, such as rigorous privacy legislations and guidelines in specific jurisdictions, improve privacy. This means that details relating to the depend on's properties and recipients are usually shut out of public documents, protecting delicate information.Moreover, making use of an offshore trust can aid reduce threats associated with possible lawful conflicts or lender cases, additionally promoting financial personal privacy. On the whole, the critical application of overseas trust funds can considerably strengthen a person's monetary discretion, permitting them to handle their estate in a discreet manner.

Selecting the Right Jurisdiction for Your Offshore Trust

When thinking about the ideal jurisdiction for an overseas trust, what aspects should be focused on? The lawful structure of the territory is vital. This consists of the count on laws, property security laws, and the general security of the legal system. A jurisdiction with distinct policies can give enhanced safety and enforceability of the trust.Another crucial consideration is tax ramifications. Jurisdictions vary considerably in their tax treatment of overseas counts on, which can affect the total effectiveness of the estate preparation technique. Additionally, a positive regulative setting that promotes personal privacy and confidentiality need to be examined, as this is commonly a key motivation for establishing an overseas trust.Finally, accessibility and administrative demands are important. Territories with reliable procedures and specialist services can help with much easier monitoring of the trust, guaranteeing that it satisfies the grantor's objectives and sticks to conformity needs.

Common Mistaken Beliefs Regarding Offshore Trusts

What are the widespread misconceptions surrounding offshore trust funds? check here Several people wrongly believe that offshore trusts are entirely for the ultra-wealthy, presuming they are specifically tools for tax evasion. In truth, offshore counts on can serve a diverse range of estate planning needs, benefiting people of numerous financial backgrounds. Another usual misconception is that these trusts are illegal or underhanded; nevertheless, when established and managed correctly, they adhere to global legislations and guidelines. Furthermore, some people fear that overseas depends on lack protection from financial institutions, yet specific territories use durable legal safeguards. There is also a belief that taking care of an overseas count on is expensive and much too complicated, which can discourage possible individuals. Truthfully, with correct assistance, developing and preserving an offshore trust fund can be much more straightforward than expected. Attending to these false impressions is essential for people thinking about overseas depends on as part of their estate preparation technique.

Steps to Developing an Offshore Trust Fund for Estate Preparation

Establishing an overseas depend on for estate preparation includes a number of essential actions. Initially, people have to choose a proper jurisdiction that lines up with their lawful and financial objectives. Next off, selecting the ideal count on assets and preparing a detailed count on record are necessary to ensure the trust fund operates successfully.

Picking the Jurisdiction

Choosing the best territory for an overseas trust is important, as it can substantially affect the trust's efficiency and the defenses it supplies. Factors such as political stability, legal framework, and tax guidelines ought to be meticulously reviewed. Territories known for solid asset protection laws, like the Cook Islands or Nevis, are often favored. Furthermore, the simplicity of maintaining the count on and establishing is essential; some regions offer streamlined procedures and fewer governmental hurdles. Access to local lawful competence can also affect the decision. Eventually, the chosen territory needs to align with the grantor's certain objectives, making certain maximum advantages while minimizing risks connected with regulatory changes or jurisdictional constraints.

Picking Trust Properties

Choosing the appropriate properties Read Full Article to put in an overseas depend on is a crucial action in the estate preparation procedure. Individuals must carefully examine their assets, including money, investments, property, and company passions, to determine which are ideal for incorporation. This analysis must take into consideration factors such as liquidity, possible growth, and tax ramifications. Diversity of possessions can improve the count on's security and assure it meets the beneficiaries' needs. Furthermore, it is necessary to represent any kind of legal limitations or tax obligation obligations that may develop from moving particular possessions to the overseas trust. Ultimately, a well-balanced selection of depend on properties can greatly influence the efficiency of the estate plan and shield the customer's long for asset circulation.

Composing the Depend On File

Drafting the trust record is a crucial action in the development of an overseas trust fund for estate preparation. This record outlines the specific terms and conditions under which the count on operates, describing the duties of the trustee, recipients, and the distribution of possessions. It is essential to plainly specify the objective of the trust fund and any kind of terms that might apply. Legal requirements may differ by territory, so talking to a lawyer experienced in overseas depends on is crucial. The document should also deal with tax implications and property defense methods. Properly executed, it not just safeguards possessions however additionally ensures conformity with global regulations, eventually assisting in smoother estate transfers and reducing prospective disagreements amongst recipients.

Frequently Asked Inquiries

How Do Offshore Trusts Affect Probate Processes in My Home Nation?

Offshore counts on can greatly affect probate processes by possibly bypassing regional jurisdictional laws. They may safeguard possessions from probate, reduce taxes, and streamline the transfer of wide range, eventually resulting in a more reliable estate negotiation.

Can I Be a Recipient of My Very Own Offshore Trust?

The question of whether one can be a recipient of their own offshore trust fund frequently occurs. Normally, people can be called recipients, however specific guidelines and implications may vary depending upon territory and trust structure.

What Occurs if I Relocate To Another Country After Establishing an Offshore Trust?

If a specific transfer to one more country after developing an overseas trust fund, they may face varying tax effects and legal guidelines, potentially affecting the depend on's administration, circulations, and reporting responsibilities according to the new jurisdiction's regulations.

Are Offshore Trusts Ideal for Small Estates?

Offshore trusts may not be appropriate for tiny estates because of high configuration and upkeep expenses. They are generally try here much more beneficial for bigger assets, where tax advantages and asset protection can justify the costs involved.

What Are the Prices Linked With Keeping an Offshore Count On?

The prices related to preserving an overseas trust commonly consist of lawful charges, administrative expenditures, tax compliance, and possible trustee fees. These costs can vary substantially based on the complexity and jurisdiction of the trust fund. Typically, people utilize offshore depends on to guard wide range from political instability, financial declines, or possible lawsuits.The core framework of an overseas trust involves a settlor, who produces the trust fund; a trustee, liable for taking care of the assets; and beneficiaries, that benefit from the trust's possessions. By putting wealth within an offshore count on, individuals can secure their possessions versus claims, divorce settlements, and other unexpected liabilities.Offshore depends on are generally governed by the laws of jurisdictions with favorable property defense laws, offering boosted protection contrasted to domestic options. By placing properties in an offshore trust fund, people can decrease the danger of undesirable exposure to their riches and financial strategies.The integral features of overseas trust funds, such as strict personal privacy laws and guidelines in specific jurisdictions, boost confidentiality. Selecting the ideal jurisdiction for an overseas count on is vital, as it can considerably influence the trust's performance and the securities it offers. Composing the count on document is a crucial step in the production of an overseas depend on for estate planning.

Report this page